Southwest Heritage Bank: Merging the Powers of Commerce Bank of Arizona, Bank 34

SPONSORED CONTENT

By Romi Carrell Wittman

Imagine having access to “big box” inventory at your favorite neighborhood store where you’ve come to rely on personalized service and local expertise. That’s precisely what Southwest Heritage Bank is doing after a recent merger.

In early 2024, Commerce Bank of Arizona merged with Bank 34, a 90-year-old community bank originally from New Mexico. The combined bank mutually changed its name to Southwest Heritage Bank to honor the legacy each bank has in the Southwest and to recognize the expanded footprint in Arizona and New Mexico. SWHB will be one of the largest community banks headquartered in Arizona. This union has strengthened the bank’s capabilities while reaffirming its commitment to the local communities it serves.

Sean Murray, SWHB’s Tucson market president, emphasizes that while the name is new, the people and principles remain unchanged.

“We’re still the same team with the same focus that Tucsonans have trusted for 22 years,” Murray explained. “Our merger has simply given us more tools to serve our community better.”

This amplified capacity is evident in the bank’s enhanced ability to handle larger loans and provide a broader range of services. Chief Credit Officer Paul Tees, a member of the Tucson leadership team, highlights the merger’s benefits: “We can be even more responsive and flexible with an increased lending capacity. And it’s all done locally by local people who understand our customers’ businesses.”

A local advisory board composed of business leaders and clients who share the bank’s passion for advancing and improving local communities is key to SWHB’s community connection. This structure ensures the bank remains deeply connected to the community it serves.

Steve Pickering, a longtime local businessman, serves as chair of SWHB’s advisory board. He said the board provides insight to the unique needs of businesses, both small and large.

“One of our key goals after the merger is to further enhance our relationship with business leaders in our community,” Pickering said. “Their counsel will generate new ideas on how to continue growing relationships with new and current bank customers.”

Mike Hammond, a principal at PICOR Commercial Real Estate Services and a member of the SWHB advisory board, said, “Our role is to ensure that the bank remains responsive to the needs of the community. We’re the bridge between the bank and the people it serves.”

Terri Gomez, SWHB’s senior relationship manager, added, “When you apply for a loan with us, you’re not dealing with an algorithm or a faceless committee halfway across the country. We are guided by the needs of the Tucson community, creating a healthy financial ecosystem across Southern Arizona.”

But what exactly makes a bank a “community bank?” The Federal Deposit Insurance Corporation generally defines community banks as those with less than $10 billion in assets. However, the true essence of a community bank lies in its approach to banking. These institutions are deeply rooted in their local areas, reinvesting deposits back into the community through loans to local businesses and individuals.

Some confuse the term “community bank” with a credit union. While they are similar, there are some key differences. Community banks are shareholder-owned and maintain a focus on small business. Credit unions mostly focus on individual clients and are member-based, non-profit organizations, allowing for more favorable income tax treatment. Typically, members must be part of a specific group to join a credit union.

In an age of digital banking and fintech disruption, the community-based SWHB competes by blending modern technology with personalized service. The bank offers all the digital conveniences of larger institutions – online banking, mobile apps, remote deposit capture – coupled with the personal touch of a community bank. Clients have access to a range of traditional banking services, including savings and checking accounts, loans and mortgages for both individuals and small businesses.

SWHB’s local focus extends beyond its banking functions to community involvement and philanthropy. The bank actively partners with local organizations and supports community initiatives, demonstrating that modern banking can coexist with traditional community values.

SWHB remains committed to the principles that have guided the bank for more than two decades: prioritizing customers and clients, valuing employees, and creating shareholder value. This balanced approach ensures that all stakeholders benefit from the bank’s success.

Looking ahead, the bank’s priorities include further enhancing its technological capabilities, expanding its range of services, and deepening its community relationships. However, the core mission remains unchanged: To be a reliable financial partner that understands and supports the unique needs of Southern Arizona’s communities.

To maintain its local-first approach, SWHB’s strategy involves preserving strong local leadership and decision-making authority in each of its markets. While each of SWHB’s markets offer unique characteristics, the goal remains unified in advancing the community-focused mission. This ensures that the community bank ethos remains intact even as the institution grows.

SWHB is not just a place to deposit checks or apply for loans; it’s a financial institution deeply invested in the success and well-being of the communities it serves. In the world of banking, SWHB is proving that it’s possible to think globally while acting – and banking – locally.

Murray said he hopes people will realize that SWHB is not a new bank in town but rather the continuation of Commerce Bank of Arizona.

In an era where banking often feels impersonal and detached, SWHB stands out for its commitment to community-focused finance. It’s a reminder that even as the financial world becomes increasingly digital and global, the demand and desire remain for local banks that prioritize personal relationships and local knowledge.

For Southern Arizonans, SWHB represents not just a bank, but a true community partner that lives and works alongside the people it serves. It’s a testament to the power of collaboration and innovation in the banking industry.

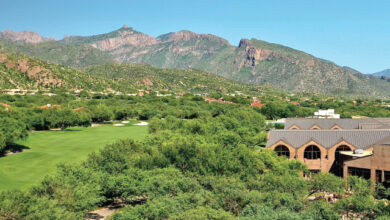

Pictured above from left – Sean Murray, Tucson Market President; Terri Gomez, Senior Relationship Manager; Paul Tees, Chief Credit Officer. Photo by Brent G. Mathis